Canada’s Energy Services Sector – A Year-End in Review

- 4 min read

PetroLMI released Q4 2021 data from Statistics Canada’s Labour Force Survey (LFS), providing a glimpse into the state of the Canadian energy services sector labour market at year-end.

Canada’s shrinking energy services labour force

Canada’s available energy services labour force has been shrinking since 2013. The cumulative impacts of a six-year industry downturn, lower demand due to COVID-19 health restrictions, and structural shifts in the oil and gas industry resulted in many workers retiring or leaving the sector entirely.

Canada’s energy services labour force declined 40% (-47,500) over the last eight years – from an average of 118,900 in 2013 to 71,400 in 2021 (see Figure 1).

Figure 1: Labour Force Characteristics for Canada’s Energy Services Sector

Source: Statistics Canada Labour Force Survey and PetroLMI, Energy Services Sector (NAICS 213), Annual Averages

Years of sustained low prices had led to significant underinvestment in the Canadian energy industry. In November, the Petroleum Services Association of Canada (PSAC) upgraded its 2021 drilling forecast due to improved activity in the second half of last year forecasting that 5,400 wells will be drilled in Canada in 2022, a 16% increase over 2021.

“Global supply-demand imbalances are leading to higher commodity prices, and we expect drilling activity to increase out of necessity. However, at the same time, we’re also seeing a severe labour shortage, which has the potential to impact how much growth the industry can achieve in the coming year.”

Gurpreet Lail, PSAC President and CEO

Improved labour market conditions in Q4 2021

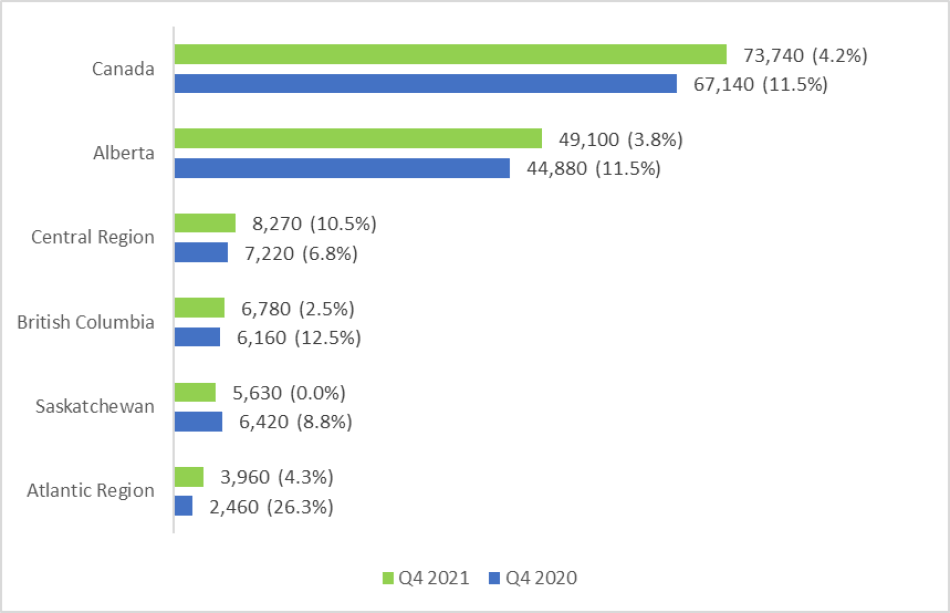

Canada’s energy services sector showed significant signs of improvement in the final quarter of 2021 which have carried through to the first quarter of 2022. Employment increased by 6,600 compared to Q4 2020, and the unemployment rate dropped to 4.2% (from 11.5% in Q4 2020).

Except for Saskatchewan, employment in the energy services sector rose in all provinces and regions in Q4 2021, compared to the previous year (see Figure 2). In Alberta, employment increased by 4,220 and the province’s unemployment rate in the sector fell to 3.8%, from 11.5% in Q4 2020. In Saskatchewan, while employment declined by about 800 year-over-year in the final quarter of 2021, virtually all of those in the energy services sector labour force were employed (see Note below Figure 2).

Figure 2: Number of Employed and (Unemployment Rate) in Canada’s Energy Services Sector, Q4 2021 and Q4 2020

Source: Statistics Canada Labour Force Survey and PetroLMI, Energy Services Sector (NAICS 213), Quarterly Averages. Central Region includes Quebec, Ontario and Manitoba. Atlantic Region includes Newfoundland and Labrador, New Brunswick, Nova Scotia and Prince Edward Island.

Note: Statistics Canada provides estimates of the number of people employed and unemployed, rounded to the nearest hundred. Together, the employed and unemployed constitute the labour force. The unemployment rate is calculated by dividing the unemployed by the labour force. Due to rounding, some regions or provinces may have a labour force equal to the number employed – resulting in the unemployment rate showing as 0%.

Did you know?

At the end of 2021, two-thirds of energy services employment in Canada was in Alberta? See more employment and labour data here.

Alberta regional analysis

Employment in the energy services sector rose in five of seven regions in Alberta in Q4 2021, compared to the previous year (see Figure 3). Most of the employment increase occurred in the Edmonton (+2,730) and Red Deer (+2,380) regions, while employment in the Calgary region declined by about 3,100. The unemployment rates dropped significantly in all regions of the province in Q4 2021. The Calgary and Lethbridge-Medicine Hat regions had the lowest unemployment rates, while the Wood Buffalo-Cold Lake region had the highest rate (11.8%).

Figure 3: Number of Employed and (Unemployment Rate) in Alberta’s Energy Services Sector, Q4 2021 and Q4 2020

Source: Statistics Canada Labour Force Survey and PetroLMI, Energy Services Sector (NAICS 213), Quarterly Averages. The Athabasca-Grande Prairie-Peace River region includes Banff-Jasper-Rocky Mountain House.

Did you know?

Employer Support and Resources are Available!

Employers are competing for the best and brightest. The labour pool is shrinking. Acceleration of the use of technologies and innovation across the energy sector is changing occupations, skills and the knowledge needed for employees to be successful. Check out a variety of employee attraction and retention resources or connect with our Employer Liaison.

Job vacancies at an all-time high in Canada’s energy services sector at year-end

Record job vacancies in the energy services sector continued in the final quarter of 2021, according to Statistic Canada’s Job Vacancy and Wage Survey (JVWS).

There were a total of 4,845 energy services job vacancies in Q4 2021, more than twice the 2,340 vacancies reported in Q4 2020. Two-thirds of the job vacancies (3,220) were in Alberta.

Labourers were in the highest demand in the quarter. Vacancies in drilling and service rig labourers (such as leasehands and roughnecks) (NOC 8615), rose to 680 in Q4 2021, from just 260 in Q4 2020. Over the same period, vacancies in drillers, servicers and testers (such as directional drillers and wireline operators) (NOC 8232) rose by 515 to 620, while vacancies in drilling and service rig operators (such as rig technicians and cementing operators) (NOC 8412), rose by 285 to 560. There were 205 vacancies in contractors and supervisors in drilling and services (such as rig managers) (NOC 8222), up from just 60 vacancies in the fourth quarter of 2020.

What’s ahead?

Watch for April Labour Force Survey data which will be available on Friday, May 6, 2022.